The Pandemic Emergency Financing Facility (PEF) was launched in 2016 by the World Bank as a response to the West Africa Ebola Crisis in 2014. It issued ‘pandemic bonds’, designed to provide immediate funding – that would likely not be available via the capital markets – to poorer countries to help them fight a large-scale outbreak of a virus or disease. Whilst the PEF bonds weren’t the first mortality-based bond – Swiss Re issued a few between 2003 and 2015..

Insurers are favouring funded re as it helps firms manage the market and longevity risks associated with writing bulk purchase annuity (BPA) business by reducing capital charges and therefore making PRT deals more competitive.

Unsurprisingly, given its growth and potential for capital optimisation, UK regulators have been carefully watching the increased use of funded re. In June 2023, the Prudential Regulatory Authority (PRA) sent a “Dear CRO’ letter to heads of risk at UK life insurers.

The letter outlined the regulator’s two main concerns from a sectoral review which it had carried out.

“One of the key risks arising in funded re is that firms recapture sub-optimal portfolios with depressed values and with limited ability to be transformed effectively to the firms’ preferred portfolio,” the PRA letter said.

Post a comment Cancel reply

Related Posts

UK Consumer Duty Barely Impacting an Equity Release Market Desperate for Interest Rates to Fall

It is now a year since UK regulator the Financial Conduct Authority (FCA) brought in…

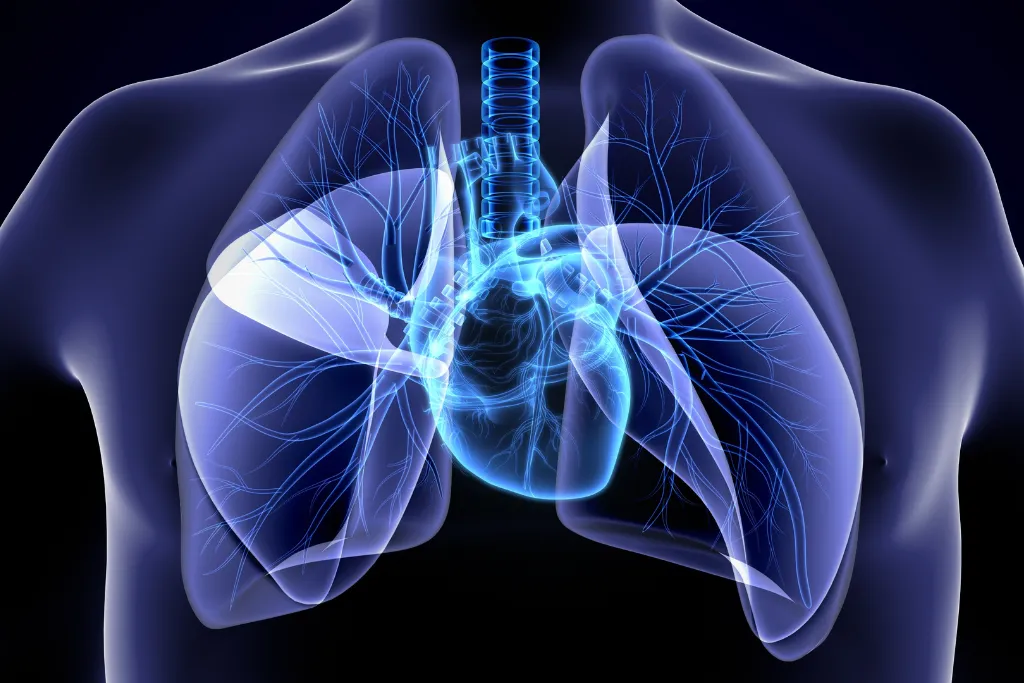

Research Demonstrates Gender Differences in Early Onset Heart Disease

Cardiovascular disease (CVD) is the world’s leading cause of death, accounting for nearly 18 million…

Seck Affirmation Keeps Return of Premium Waters Muddy for Life Settlement Market

Life settlement asset managers pay significant sums of money to keep a life insurance policy…

US Authorities Leave Pension Risk Transfer Rules Untouched

The US Department of Labor (DOL) has concluded its review of the regulatory framework for…