The alternative credit industry experienced something of an up-and-down year in 2023. On one hand, fundraising pulled back as investors rotated into more liquid, higher yielding credit investments, and on the other, existing funds, particularly in the private debt space, with floating rate loans enjoyed higher returns. The impact of higher interest rates was certainly felt keenly in the life ILS corner of the alternative credit space last year, in both capital raising and…

Insurers are favouring funded re as it helps firms manage the market and longevity risks associated with writing bulk purchase annuity (BPA) business by reducing capital charges and therefore making PRT deals more competitive.

Unsurprisingly, given its growth and potential for capital optimisation, UK regulators have been carefully watching the increased use of funded re. In June 2023, the Prudential Regulatory Authority (PRA) sent a “Dear CRO’ letter to heads of risk at UK life insurers.

The letter outlined the regulator’s two main concerns from a sectoral review which it had carried out.

“One of the key risks arising in funded re is that firms recapture sub-optimal portfolios with depressed values and with limited ability to be transformed effectively to the firms’ preferred portfolio,” the PRA letter said.

Post a comment Cancel reply

Related Posts

UK Consumer Duty Barely Impacting an Equity Release Market Desperate for Interest Rates to Fall

It is now a year since UK regulator the Financial Conduct Authority (FCA) brought in…

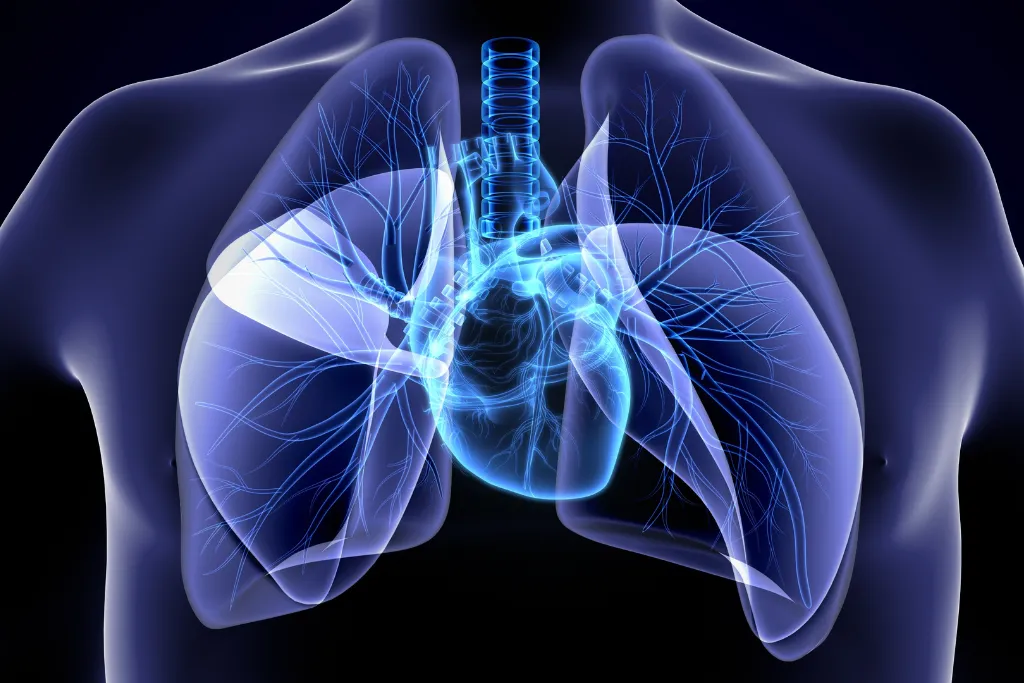

Research Demonstrates Gender Differences in Early Onset Heart Disease

Cardiovascular disease (CVD) is the world’s leading cause of death, accounting for nearly 18 million…

Seck Affirmation Keeps Return of Premium Waters Muddy for Life Settlement Market

Life settlement asset managers pay significant sums of money to keep a life insurance policy…

US Authorities Leave Pension Risk Transfer Rules Untouched

The US Department of Labor (DOL) has concluded its review of the regulatory framework for…